Jan 02 2015 A Network Mapping of Investments in Civic Tech

The growing trend of civic technology is presenting new opportunities for cross-sector collaboration; the expansion of civic tech has, in large part, been propelled by the willingness of private and philanthropic funders to invest in the field, build capacity, and provide expertise. The Knight Foundation’s 2013 report, The Emergence of Civic Tech: Investments in a Growing Field, illuminates these trends, providing valuable information on private and philanthropic investment flows to for-profit companies, start-ups, and non-profit organizations that are working to advance the civic tech field. This type of information can assist investors and grantees alike in understand the larger context in which they operate and in thinking about ways that investments can be maximized.

The growing trend of civic technology is presenting new opportunities for cross-sector collaboration; the expansion of civic tech has, in large part, been propelled by the willingness of private and philanthropic funders to invest in the field, build capacity, and provide expertise. The Knight Foundation’s 2013 report, The Emergence of Civic Tech: Investments in a Growing Field, illuminates these trends, providing valuable information on private and philanthropic investment flows to for-profit companies, start-ups, and non-profit organizations that are working to advance the civic tech field. This type of information can assist investors and grantees alike in understand the larger context in which they operate and in thinking about ways that investments can be maximized.

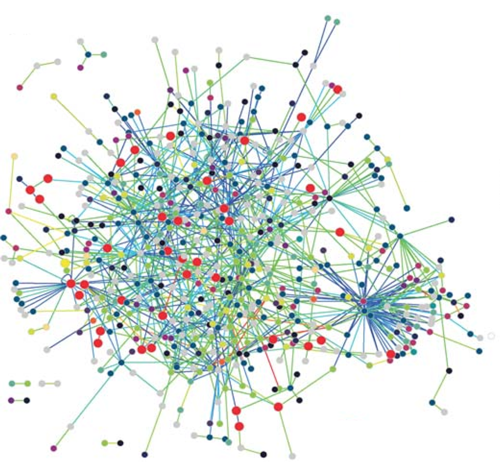

To develop this report, the Knight Foundation partnered with Quid, a data analytics firm, to conduct a network analysis and mapping of the U.S.-based players in this burgeoning field. The study is not meant to be exhaustive but rather an initial assessment of the key findings and implications regarding the core organizations and investors advancing civic tech. The report is primarily based on investment data from corporations, foundations, and private investors that provided funding for projects between January 2011 to May 2013.

From 2008 to 2012, the field of civic tech grew 23 percent annually.

The report highlights that from 2008 to 2012, the field of civic tech grew 23 percent annually. Researchers grouped the core organizations and companies included in the report under two overarching categories: Open Government and Community Action. and further categorized them within specific clusters according to their function and purpose such as Information Crowdsourcing and Public Decision Making. They found that the Community Action cluster grew at a higher rate than the Open Government, with the fastest growth experienced by peer-to-peer sharing platforms like Lyft, which attracted close to $240 million, the largest total amount of investments for any cluster.

The report also analyzed the balance between philanthropic and private investments and found that 84 percent of total capital invested in civic tech came from the private sector. A closer look at capital flows reveal that financial investors and individuals account for the majority of Community Action investments, while foundations make up more than half of the number of investments in the Open Government cluster.

A key takeaway from the report is the current lack of co-investments and collaboration occurring at the investor and grantee level. Public funding was excluded from the study, and further research on how the public sector is investing in civic technology and integrating projects into existing government operations may shed light on valuable intersections or nodes that may be enhanced through cross-sector partnerships. Private investors and foundations can also encourage each other to integrate their investments and expertise and engage the public sector to maximize the potential of projects, potentially changing the way we engage with each other, with goods and services, and with the institutions that structure our society.